The first quarter of 2024 marks the lowest number of transactions involving impaired loans in recent years according NPE Maket Observatory by Credit Village

Even though usually the first three months of the year are physiologically less eventful than the following quarters, the drop in 2024 is quite significant: 68 deals completed for a total GBV of EUR 2.2 billion between primary and secondary markets. In the same period of 2023, 79 disposals with a GBV of EUR 3.1 billion were recorded by Credit Village's NPE Market Observatory.

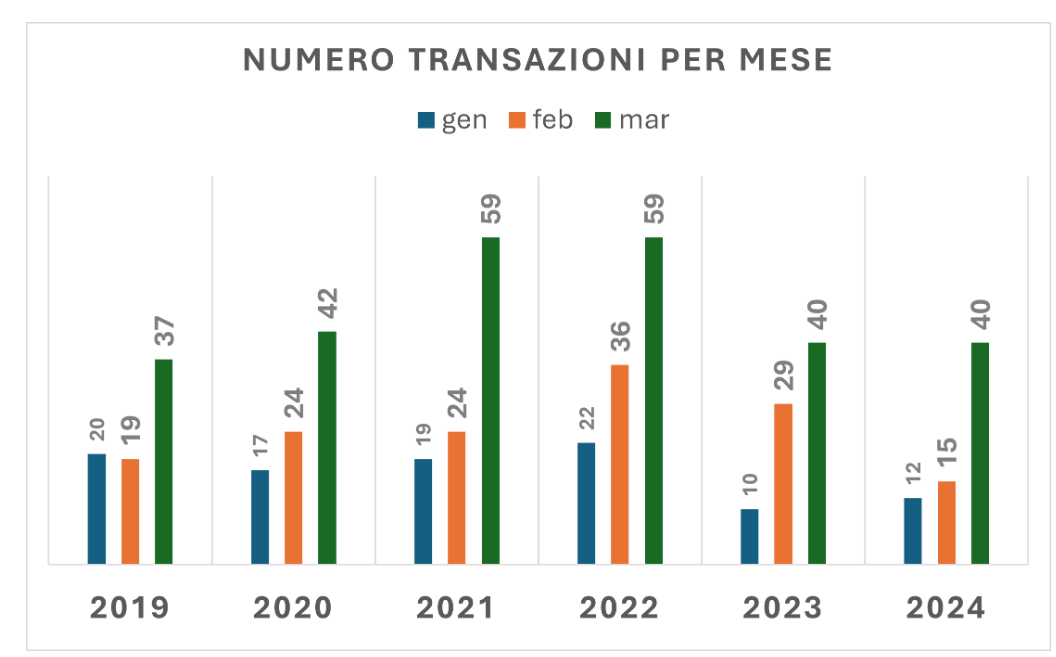

The decline occurred mainly between January and February, while in March the number of transactions realigned to that of 2023.

While this trend was to be expected in the primary market, what continues to be evident is the poor performance of the secondary market. As is now well known, the stock of NPLs and UTPs still held by debt buyers, who acquired them in the past, exceeds EUR 300 billion of GBV, and many of these portfolios are performing poorly compared to their original business plans.

Although a few significant deals in terms of GBV were recorded between April and May 2024 (we will discuss this in more detail in our Q2 2024 Observatory Report) , the potential of this market remains untapped, influenced by some critical factors that make it complicated for investors to adopt divestment policies and strategies.

While the divestment of a portfolio or segments of it would benefit the divesting investor in terms of immediate cash flow realisation, it would also force him to revise his original business plans with repercussions on both future collection curves and IRRs, which are conditioned by the decrease in GBV and the number of overall positions that would remain under management.

NPL Securitisations – Transaction Structures

A recent commentary by Morningstar DBRS provides an in-depth analysis of the transaction structures for publicly rated Italian non-performing loans (NPLs) securitizations. This evaluation covers the financial structure's impact on senior notes' collateralization, amortization speed, exposure to interest rate risk, and the significance of the state-guarantee GACS premium.

However, both the primary and secondary markets have to deal with other aspects as well.

The rise in interest rates and the consequent cost of funding make it complicated to match the expectations of sellers and buyers on the transfer price; the slowdown in the real estate market has a significant impact on secured loans, whose value is closely linked to that of the asset as collateral; Consumers and businesses are finding it increasingly difficult to comply with payment agreements for their debt exposures due to the increase in the cost of living and supplies, impacting cash flows.

The sector's regulatory system, still not well defined with regard to the transposition of Directive 2167/21, which should reform at least in part the sector's regulations for credit servicers and debt buyers, is generating a climate of expectation, especially for certain types of operators; Certain judiciary rulings and guidelines on issues related to the assignment of receivables, lead to a greater degree of risk assessment and management by investors, especially with regard to portfolios with more advanced ageing, typical of the secondary market.

Returning to the overall performance of the first quarter of 2024, the most dynamic investor was certainly the Swedish group Hoist Finance, which acquired over EUR 1bn of GBV through 6 completed transactions between primary and secondary markets. It is worth mentioning that in the second quarter of 2024, Hoist Finance was also involved in a major divestment of over 1.2 billion GBV in favour of Cherry Bank and Sorec.

Other investors that were active in this first period of the year were in particular Guber Bank, with a series of purchase transactions of both NPL and UTP loans, and the KRUK Group, with purchase transactions carried out on the primary market. The other Group with headquarters in Poland, Best, also seems to have resumed its activities of purchasing portfolios of both banking and financial origination.

Rising Refinancing Risk

According to Fitch Ratings, global debt purchasers are encountering increased refinancing risk due to less reliable access to debt capital markets and difficulties in executing deleveraging plans amid pressures on collection rates. While some stronger debt buyers have recently accessed markets, those with weaker credit profiles or upcoming debt maturities may find it challenging to refinance at a manageable cost.

Entering Italian NPE Market is a newsletter and a Linkedin Group focused on News, Updates and Insights on Italian Banks, Ditressed Credit Market, Fintech and Real Estate.

Relevant Links:

https://www.creditvillage.news/cvstudi_ricerche/

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics