According to Fitch Ratings, global debt purchasers are encountering increased refinancing risk due to less reliable access to debt capital markets and difficulties in executing deleveraging plans amid pressures on collection rates. While some stronger debt buyers have recently accessed markets, those with weaker credit profiles or upcoming debt maturities may find it challenging to refinance at a manageable cost.

Debt purchasers acquire non-performing loans (NPLs) from banks and other originators at discounted prices, aiming to collect them profitably over several years. The sector saw significant growth during the low-interest-rate period following the 2007–2008 financial crisis and the pandemic, aided by regulatory pressure on banks to dispose of problematic assets.

However, interest rate hikes in 2022 and 2023 have increased funding costs, necessitating stricter pricing when acquiring new NPL portfolios. Higher rates are also likely to reduce profitability for partially collected portfolios, as debtors’ repayment capacities are strained by cost-of-living increases.

NPE market down 10% yoy

The latest edition of the CRIBIS Credit Management NPE Observatory reveals significant developments in the Non-Performing Exposures (NPE) market throughout 2023. The research was produced in collaboration with Credit Village To receive new posts and support my work, consider becoming a free or paid subscriber.

Fitch's outlook for debt purchasers in 2024 is ‘deteriorating’. In March, Intrum's rating was downgraded by two notches, and in May, Lowell's rating was downgraded by one notch. Ratings for debt purchasers, typically in the ‘B’ and ‘BB’ categories, already reflect their sensitivity to wholesale funding. However, an inability to access capital markets could further erode rating headroom, leading to further negative rating actions.

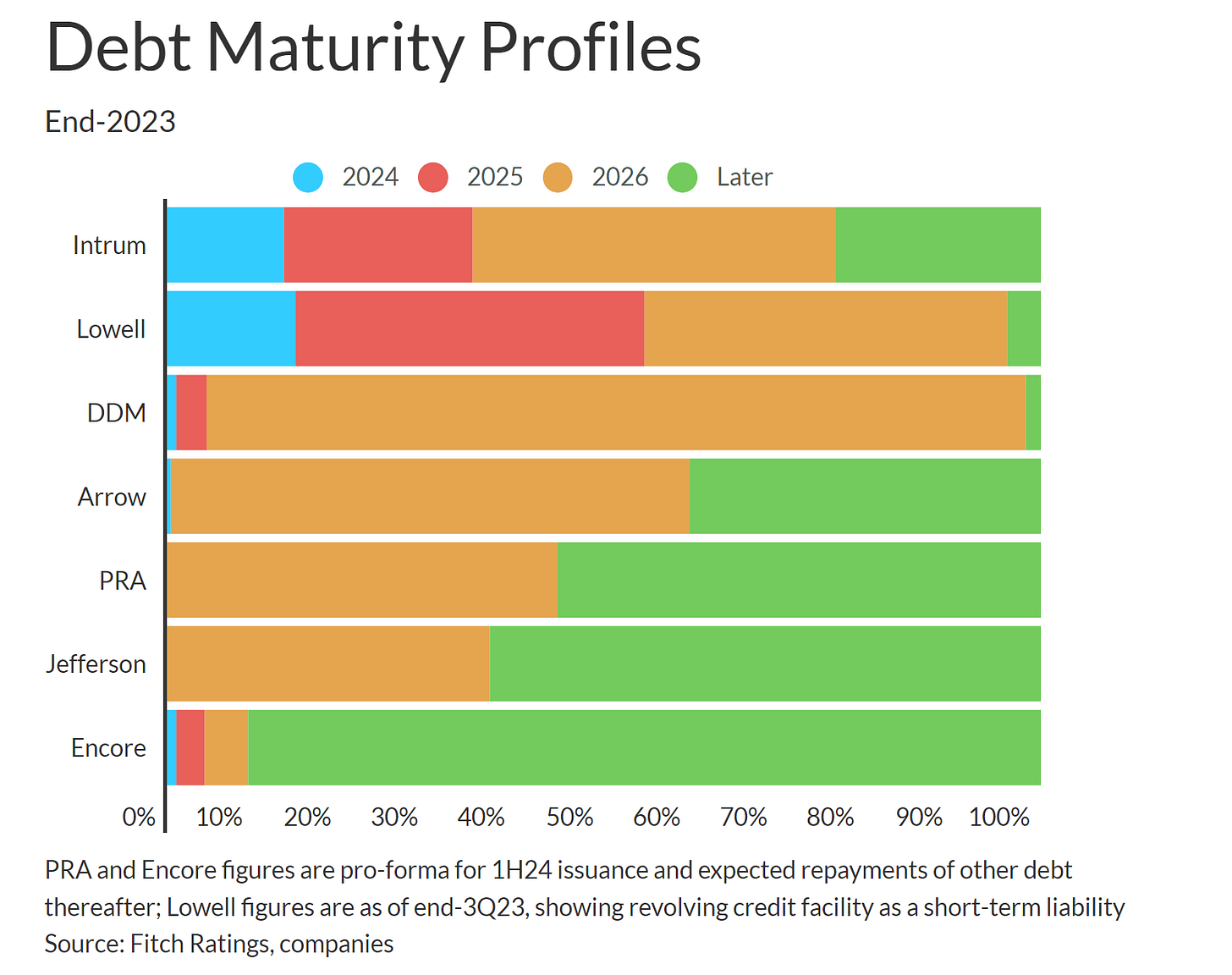

This year’s challenging funding market conditions have underscored differences in debt purchasers’ funding and leverage profiles. Companies with lower leverage and more staggered debt maturities, such as Encore Capital (BB+/Stable) and PRA Group (BB+/Negative), have managed medium-term maturities by issuing benchmark-sized bonds. In contrast, those with concentrated funding profiles, like Intrum and Lowell, have not yet refinanced their 2025 maturities.

Current bond yields suggest that refinancing would incur significantly higher rates than existing funding costs, adding pressure to some firms' business models. Some debt purchasers are managing higher interest rates by focusing more on capital-light revenue, such as debt servicing or managing portfolios for third-party investors. However, these adjusted business models have yet to be fully validated, potentially affecting their ability to secure competitive funding.

Debt purchasers with weaker credit profiles face increased risks of debt exchange or “amend and extend” transactions, which could negatively impact Fitch’s assessment of their funding and liquidity profiles. In adverse scenarios, such transactions could be classified as distressed debt exchanges. Intrum and iQera Group (unrated) have both recently appointed financial advisors to review their capital structures, potentially leading to debt restructurings.

Despite the cost-of-living pressures on debtors, rated debt purchasers generally performed well in collections in 2023 and the first quarter of 2024. However, they continue to face inflationary pressures on their own overheads and finance costs.

Although recent negative rating actions have affected some issuers, debt maturities for debt purchasers in the second half of 2024 to 2025 are relatively modest. However, maturities increases significantly in 2026, with new funding likely to be more expensive than the funding it replaces, even if policy interest rates have eased.

Entering Italian NPE Market is a newsletter and a Linkedin Group focused on News, Updates and Insights on Italian Banks, Ditressed Credit Market, Fintech and Real Estate.

Relevant Links:

https://www.fitchratings.com/research/non-bank-financial-institutions/global-debt-purchasers-face-increasing-refinancing-risk-24-05-2024

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics