Update on Italian NPL Collections

Scope Ratings published its monthly report on Italian NPL Securitizations

According to Scope Ratings laterst report, Italian NPL collections benefited from the seasonal uplift that has been evident in the past three years, albeit in different proportions. Month over month, collections rose 65%in December 2021, compared with 55% in December 2020 and 81% in December 2019.

The seasonality drivers are the same as those of previous years:

servicers achieving year-end targets based on internal incentive schemes,

year-end corporate accounting requirements (i.e. clean-up of past-due debts), and

better affordability due to payment of bonuses and 13th or 14th salary installments.

Year on year, there was a change in servicers’ strategies. In 2021, servicers relied less on judicial strategies than in 2020 and more on DPOs, while they completed note sales at the same pace. In 2021, the average share of judicial collections was 59% of monthly volumes (67% in 2020), the share of DPOs was 32% (24% in 2020), the share of note sales was 8% in both years.

More DPOs and less judicial proceeds in 2021 can be explained by:

increased willingness by borrowers to close positions extra-judicially owing to better affordability conditions on the back of the improved macroeconomic scenario, and

servicers frontloading collections with extra-judicial routes given delays in judicial proceedings.

Courts were still trying to deal with previous backlogs and poor transaction volumes were close to triggering structural events such as under-performance and subordination events.

Intesa Sanpaolo Published its 3 years Business Plan self claiming as a sound bank for a sustainable world, a wealth management, protection & advisory leader, a zero-npl, digital and fee-driven company, with significant ESG commitment.

Key Features of the plan include:

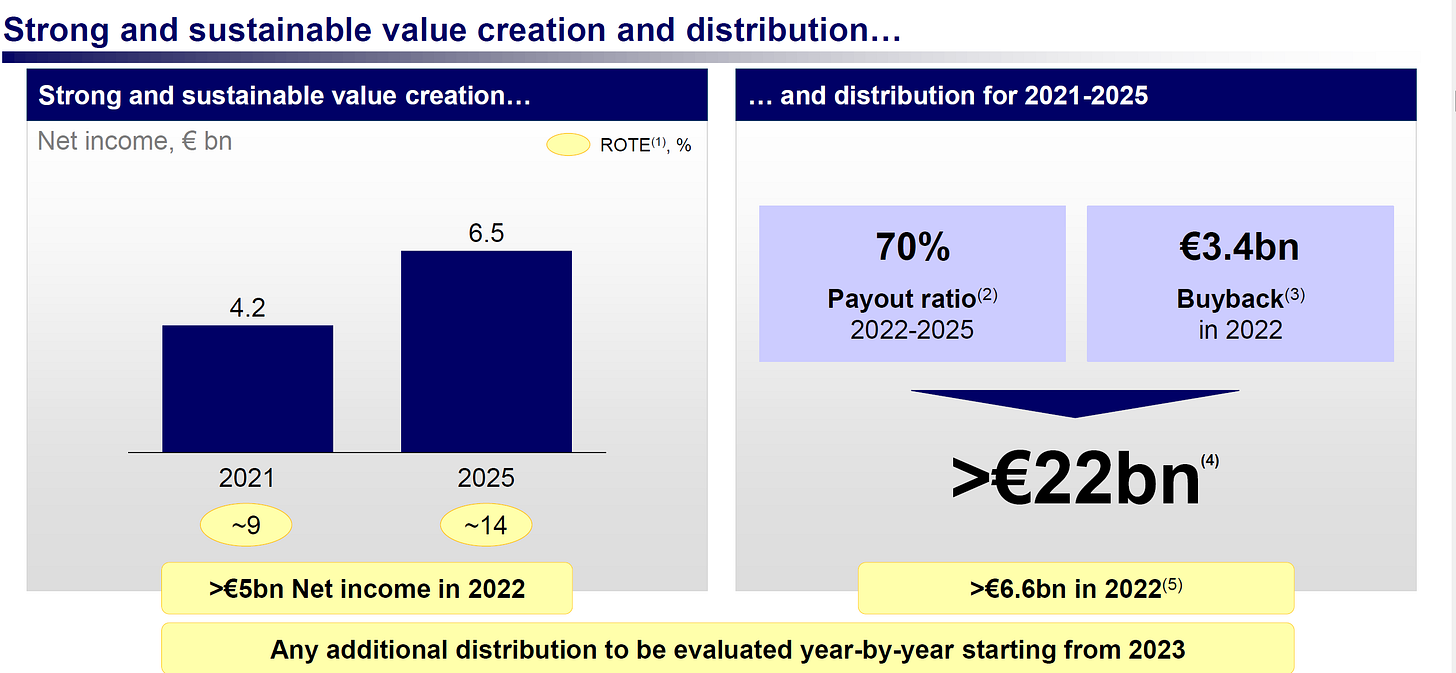

strong and sustainable value creation and distribution to shareholders:

- rote up to around 14% in 2025;

- net income up to €6.5bn in 2025;

distribution for 2021-2025 of over €22bn, of which over €6.6bn in 2022, through cash dividends with a payout ratio of 70% in 2022-2025 and buyback of €3.4bn in 2022. any additional distribution will be evaluated on a yearly basis starting from 2023

solid capital position: fully phased-in common equity tier 1 ratio above 12% in 2022-2025 in accordance with basel 3 / basel 4 regulations.

massive de-risking:

npl to total loan ratio of 0.8%, net of adjustments, in 2025;

cost of risk of around 40 basis points in 2022-2025.

structural cost reduction, while significantly investing in technology and growth:

operating costs down around €0.3bn in 2025, with €2bn of cost savings and €1.1bn costs for growth in 2022-2025;

cost/income improvement, down to 46.4% in 2025;

investments of €7.1bn in 2022-2025, of which €5bn in technology and growth, including around €650m in a new digital bank.

solid revenue generation:

operating income up €2bn in 2025, of which €1.6bn from commissions and €0.2bn from insurance business;

net commissions and income from insurance business accounting for 57% of operating income in 2025.

significant esg commitment:

contribution, in 2022-2025, of around €115bn to society and green transition and around €500m to support people in need;

net-zero emissions, in terms of own emissions by 2030 and in terms of loan and investment portfolios, asset management and insurance by 2050..