Scoper Ratings publishes regularly a report on the performance of a static universe of Italian NPL securitisations originated pre-Covid updating collections with info from monthly servicing reports

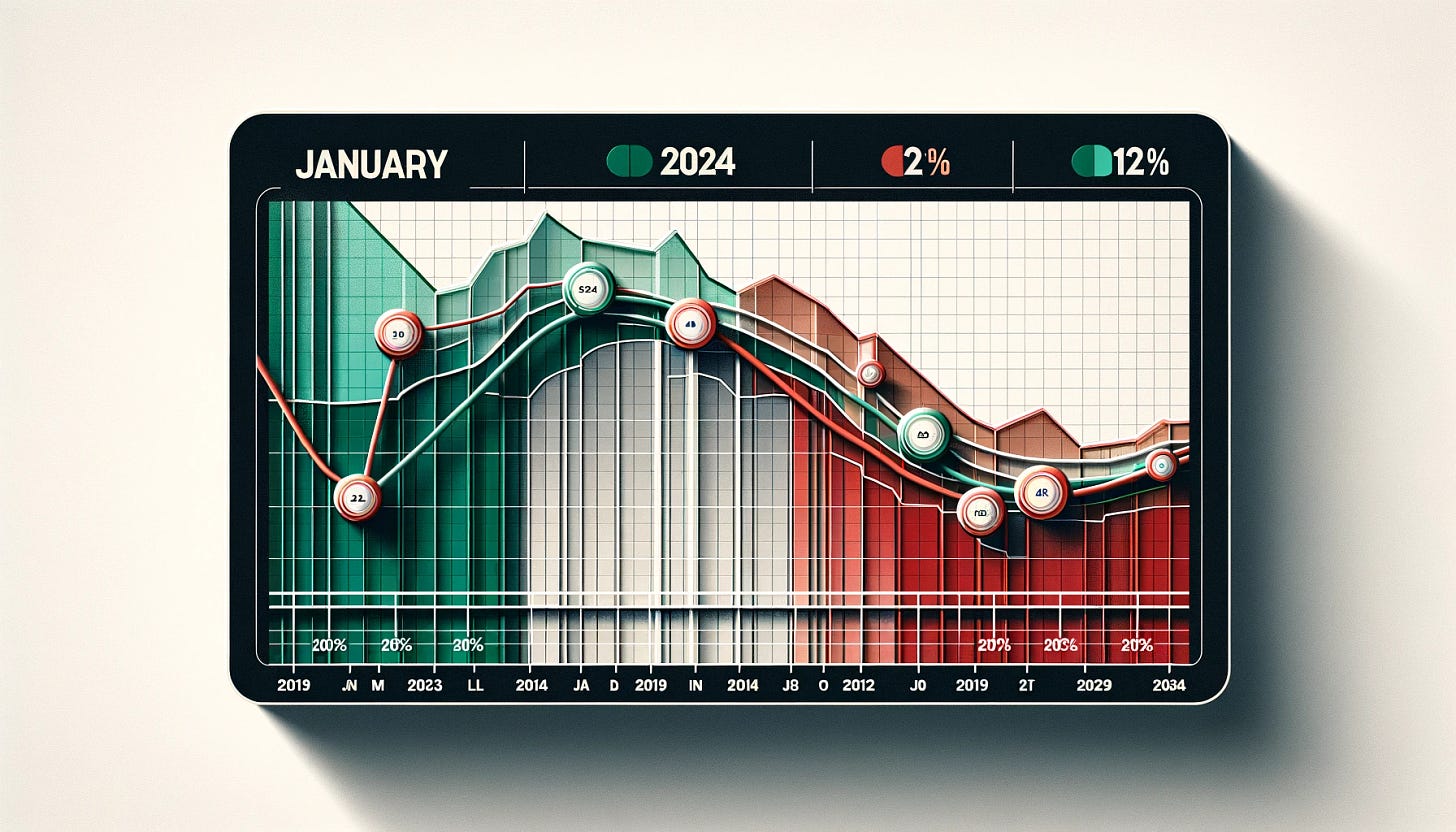

January 2024 Italian NPL collections of EUR 99m were 56% down month-on-month and 12% below the January average of the three previous years, continuing the declining trend observed throughout 2023. The relevant difference with December figures is due to Seasoanl effect.

Based on 20 transactions where the breakdown of collections was specified, judicial proceeds amounted to EUR 64m and extrajudicial strategies EUR 18m, of which EUR 14m from DPOs and EUR 4m from note sales. Two transactions reported EUR 17m in collections but did not provide a breakdown.

Entering Italian NPE Market is a newsletter and a Linkedin Group focused on News, Updates and Insights on Italian Banks, Ditressed Credit Market, Fintech and Real Estate.

Relevant Links:

https://scoperatings.com/ratings-and-research/research/EN/176571

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics