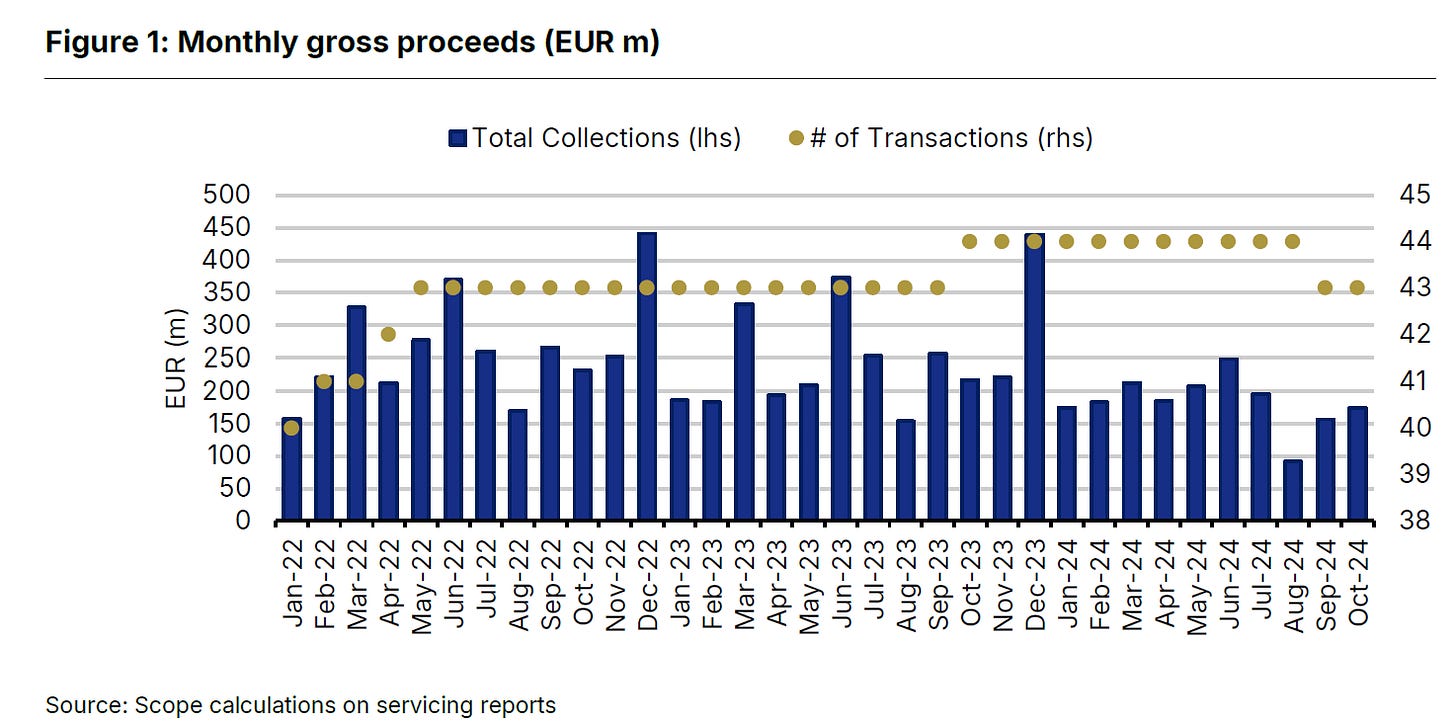

According to the latest issue of the report by Scope Ratings Italian NPL collections rose by 11% month-on-month in October but were significantly below the volumes recorded in the same month of the past two years.

Scope ratings published its regular update on Italian NPL collections pointing out an increase by 11% month-on-month in October. However monthly collections were significantly below the volumes recorded in the same month of the past two years.

October collections of EUR 174m were EUR 17m higher than September’s but were 23% lower than the average of October 2022-2023, continuing the negative trend observed in previous months.

A significant trend this year has been the rise in the share of judicial collections. During the first ten months, these collections represented 70.3% of the total gross revenue, exceeding the average for the same period in 2021-2023 by over 10 percentage points.

The report shows the performance of a static universe of Italian NPL securitisations rated by Scope and is based on monthly servicing reports available to October 2024.

European CMBS

The European office sector, a cornerstone of commercial real estate (CRE), has undergone significant upheaval since the COVID-19 pandemic. High inflation, increased interest rates, and shifting work habits have posed challenges, while recent central bank rate cuts have sparked renewed optimism in CRE markets.

Entering Italian NPE Market is a Newsletter and a Linkedin Group focused on News, Updates, and Insights on Italian Banks, Distressed Credit Markets, Fintech, and Real Estate.

Relevant Links:

https://scoperatings.com/ratings-and-research/research/EN/178136

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics