Scope Ratings publishes on a regula base a report on the performance of a static universe of Italian NPL securitisations originated pre-Covid and rated by Scope.

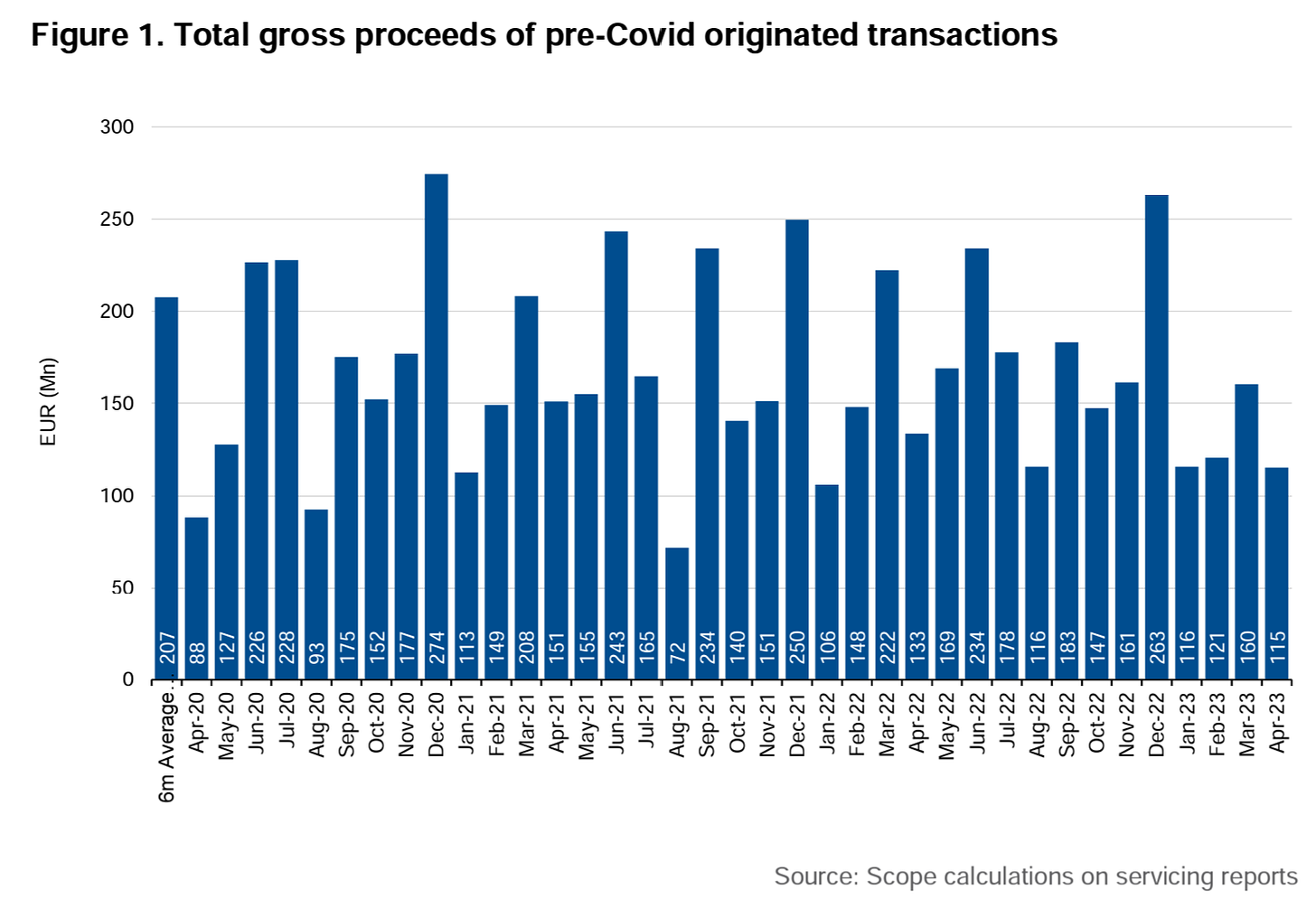

April Italian NPL collections fell 28% month-on-month and were 13% and 23% below April 2022 and 2021 volumes, respectively. The difference is mainly due to a 47% decline in DPO proceeds relative to the average of the two previous years.

Note sales have been consistently low since the beginning of 2023 in the context of rising interest rates, which we noted in last month’s edition of this report.

The report is based on monthly servicing reports available to April 2023.

Scope is going to held a Webinar on ReoCos in Italian NPL securitisations – review and outlook scheduled for Tuesday 5 September 15:30 CET

The Italian NPL market has seen a revitalisation of ReoCo structures in recent years. Join us for this webinar when Rossella Ghidoni and Paula Lichtensztein from Scope’s structured finance team will outline the advantages of using ReoCo structures in shortening recovery timing and increasing recovery amounts, and explain why they believe ReoCos have potential despite limited activity and disappointing profitability to-date.

Link to Register for the Webinar

Link to the Report:

https://scoperatings.com/ratings-and-research/research/EN/174554

This newsletter is free please consider supporting it with a small donation

Check my personal blog mostly in Italian

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics