The report assesses the performance of a fixed group of Italian NPL securitisations rated by Scope, based on monthly servicing data available through December 2024.

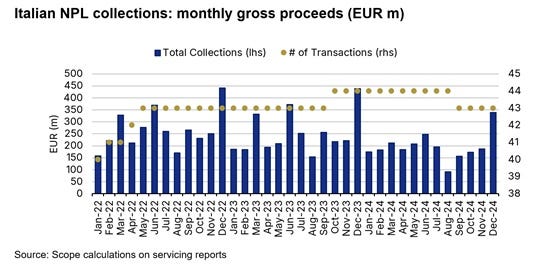

Italian NPL collections saw a sharp 81% month-on-month increase in December 2024, reaching EUR 339m, continuing the trend of December that is the peak month for collections. However, despite this surge, volumes remained 23% lower than the December average for 2022 and 2023.

Over the entire year, collections were down 24% compared to the previous two-year average, with every month—except January—falling short. The steepest decline occurred in August, with a 43% drop. Older transactions experienced a notable downturn in 2024 compared to 2023, with judicial proceeds and DPOs decreasing by 18% and 38%, respectively. While judicial proceeds for newer transactions remained consistent with 2023 levels, DPOs saw a 29% decline.

#SaveTheDate NPL Days Italy

The 5th edition of the NPL Days Italia conference will take place on February 13th in Milan. This leading conference for Italian NPLs and distressed debt will bring together top experts, investors, and professionals in the industry. To receive new posts and support my work, consider becoming a free or paid subscriber.

Entering Italian NPE Market is a Newsletter and a Linkedin Group focused on News, Updates, and Insights on Italian Banks, Distressed Credit Markets, Fintech, and Real Estate.

Relevant Links:

https://scoperatings.com/ratings-and-research/research/EN/178363

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics