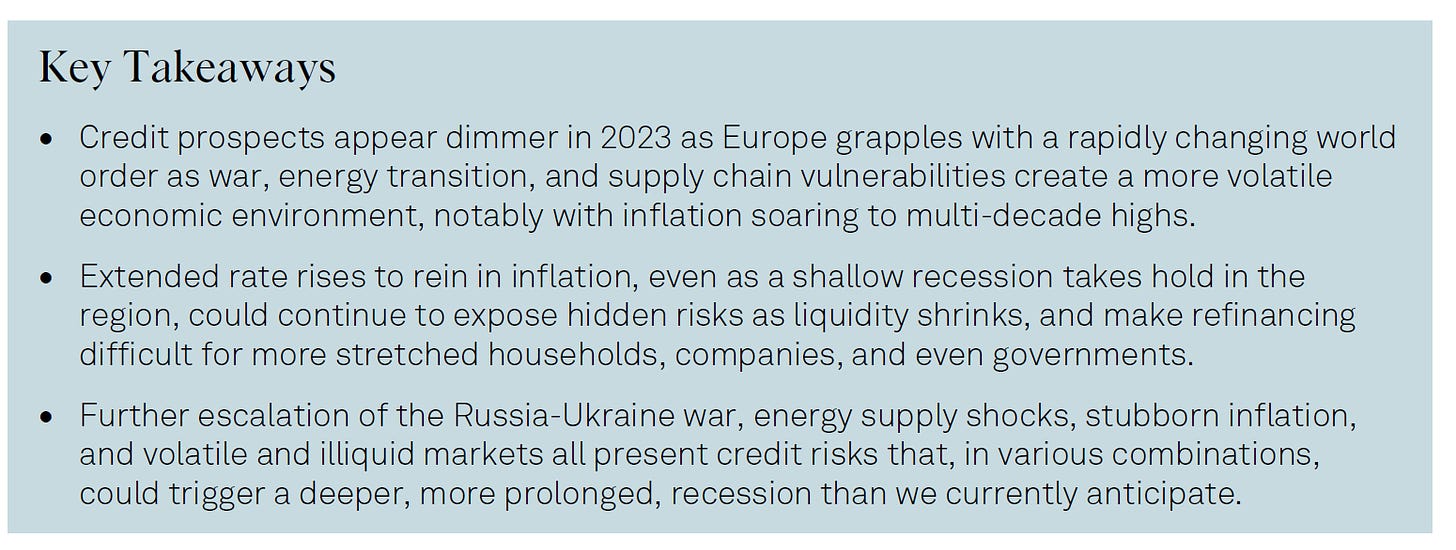

The credit quality of energy-intensive, consumer discretionary, and leveraged corporate sectors will likely be hit hardest in 2023. Broadening input cost pressures, rising funding costs, and potential contractions in demand will increasingly weigh on earnings, particularly in more competitive sectors lacking pricing power.

Vulnerabilities are expected to surface among companies rated 'B-' and lower, either unable to refinance or extend maturities on a timely basis, or overly exposed to variable rates, leading to a moderate increase in the default rate (including distressed exchanges) to 3.25% by autumn next year under our base case. Retail, media and entertainment, capital goods, and consumer products are the sectors most exposed on this basis.

The rating outlook for European banks remains relatively stable. Despite a weakening macro environment, higher interest rates mean improving net interest margins, underpinning earnings. We expect asset quality to deteriorate (unevenly by region and sector), but the resulting rise in credit losses will be manageable and absorbed by earnings. Weak growth and inflation pressures will primarily affect lending to small and midsize enterprises and consumers.

Residential mortgage performance will hold up, even if property prices slip, thanks to high employment, low loan-to-value ratios and banks managing risk more proactively by offering some flexibility of terms to borrowers in difficulty. Furthermore, banks face 2023 with solid capital and liquidity. A more severe, spread-out recession in Europe, however, could lead to more negative outlooks emerging.

European sovereigns' ability to bail out the real economy is reaching its limit. The ability of economic authorities to pay for the cost of yet another global economic emergency (the energy price shock from the Russia-Ukraine war) has become restricted by central banks refocusing on their core price-stability mandates. Most European governments' post-pandemic debt is high, implying a withdrawal of fiscal policy commencing in 2023 and accelerating in 2024, with some notable exceptions.

A higher cost of living and increased financing costs will be in the spotlight for structured finance. As European consumers feel the strain of rising living costs, we anticipate deteriorating collateral performance will first appear in asset-backed securities (ABS) backed by loans to non-prime borrowers or unsecured receivables. For residential mortgage-backed securities, borrowers in the nonconforming sector typically have well-seasoned loans with low balances, making rate rises less onerous than for borrowers with higher leverage.

The labor market's strength is likely to remain a key credit factor underpinning the collateral performance in consumer-related structured finance sectors. Investment-grade tranches in securitizations are generally well-positioned to weather a potential rise in underlying delinquencies or defaults, benefitting from strong built-in protections.

Link to the Report

https://www.spglobal.com/ratings/en/research/pdf-articles/221201-credit-conditions-europe-q1-2023-time-to-face-the-music-101570033

This newsletter is free please consider supporting it with a small donation

Check my personal blog mostly in Italian

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics