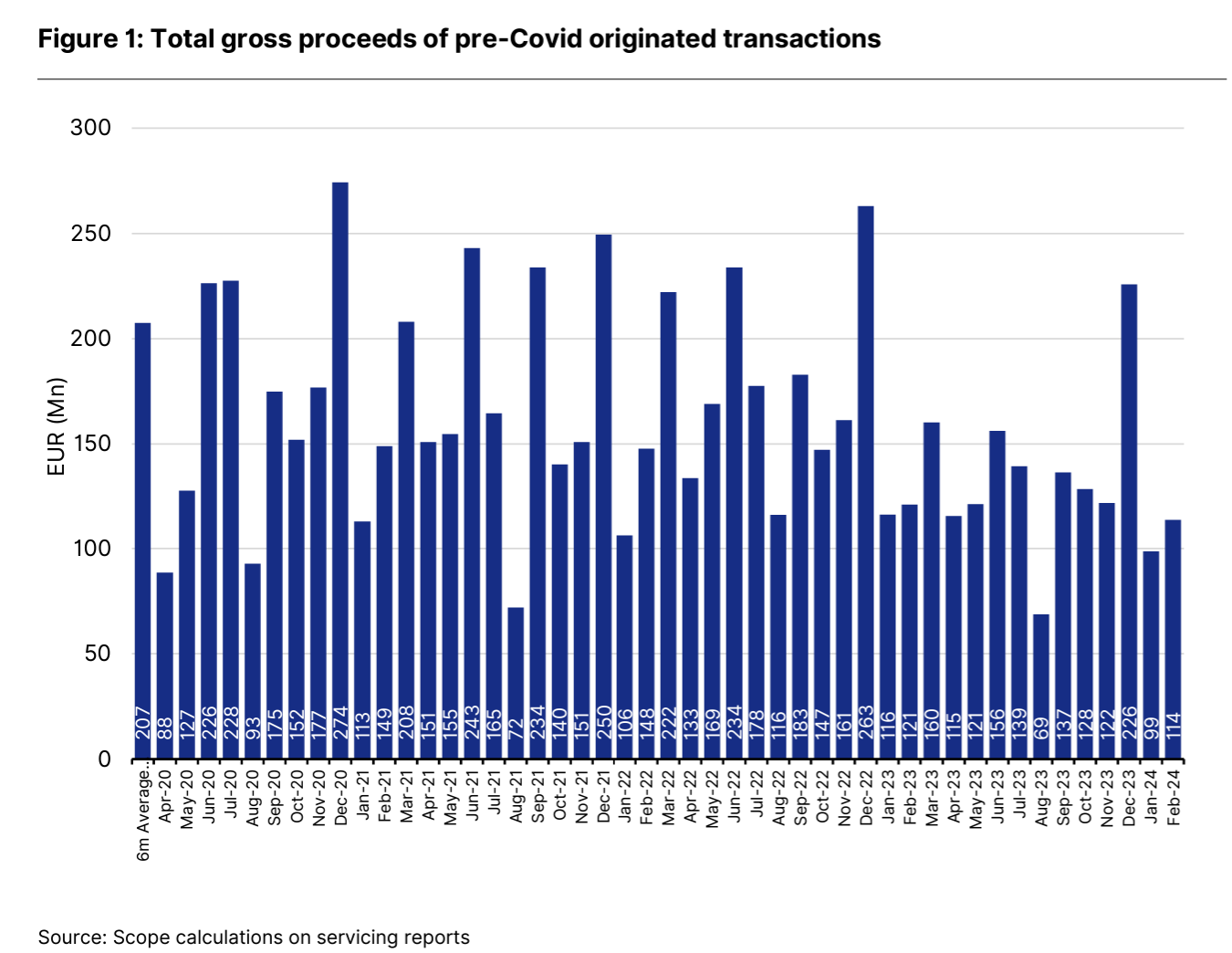

Scope Ratings published an update of its report based on monthly servicing reports available to February 2024 showing the performance of a static universe of Italian NPL securitizations originated pre-Covid.

The performance of the operations rated by Scope revealed a significant dip in note sales during February, nearly hitting zero. Although there was a month-over-month uptick of 15% in collections amounting to EUR 114 million, this figure fell short by 18% when compared to the average for February over the past three years.

In a stark contrast, note sales plummeted to a meager EUR 45,000, a stark decline from the EUR 11 million average noted in February of the preceding three years, marking it as the most pronounced decline since the initiation of this report in April 2020, and it underscores a continuation of the downward trend identified in 2023.

Despite judicial strategies and deferred payment obligations (DPOs) in February performing in line with the patterns before 2021, they were unable to counterbalance the void created by the reduced note sales.

In actual EUR value, the gains from these strategies and obligations were still lagging by 11% and 22% respectively, compared to the February averages of the prior three years. The report's insights are derived from monthly servicing reports that were accessible up to February 2024.

Entering Italian NPE Market is a newsletter and a Linkedin Group focused on News, Updates and Insights on Italian Banks, Ditressed Credit Market, Fintech and Real Estate.

Relevant Links:

https://scoperatings.com/ratings-and-research/research/EN/176693

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics