GACs 17 su 26 sono indietro sul Business Plan

Il Sole 24 Ore riporta vendite sul secondario di note Mez e Junior

In base alle rilevazioni di Scope Ratings sugli incassi delle operazioni di cartolarizzazione, in Italia 17 operazioni su un totale di 26 presentano incassi al di sotto di quanto previsto dai business plan originari. Secondo indiscrezioni riportate da IlSole24Ore ci sarebbero alcuni investitori che stanno già vendendo i loro titoli «junior» e «mezzanini» , per permettere a chi li acquista di cambiare Servicer, cioè di sostituire le società incaricate di recuperare i crediti in sofferenza.

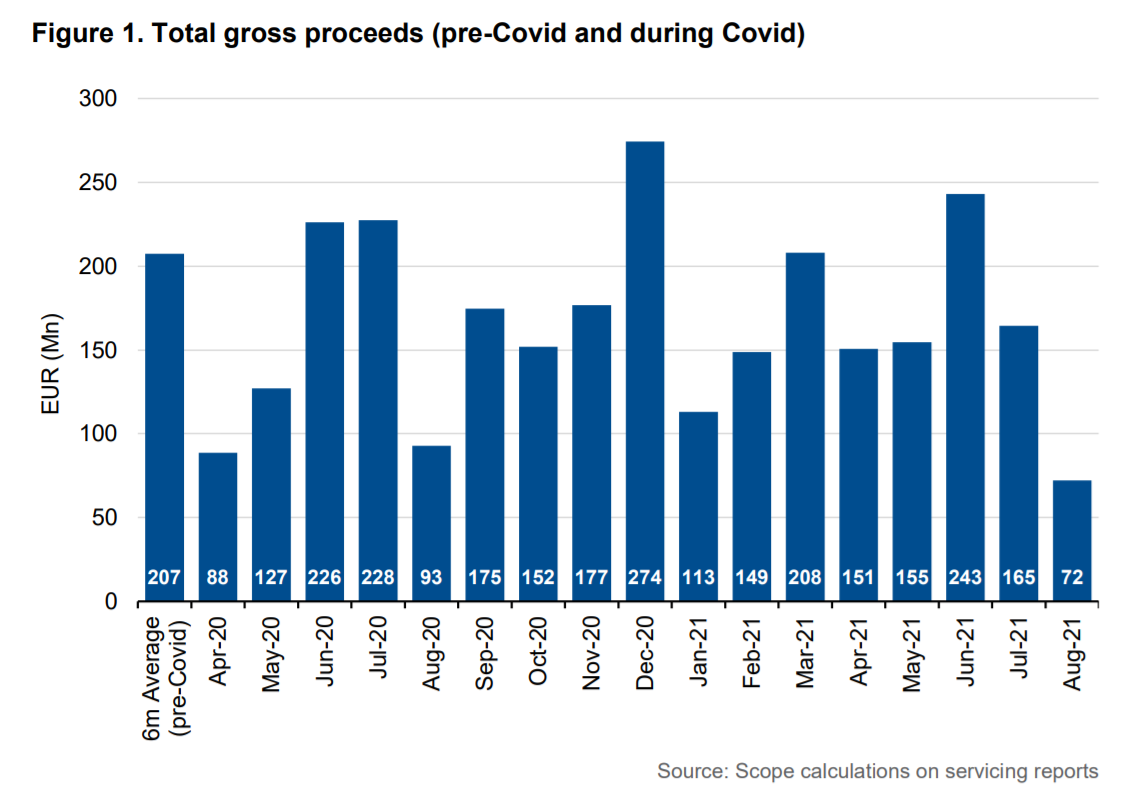

Italian NPL collections suffered a 56% monthly reduction in August to EUR 72m, consistent with August of the previous two years and explained by seasonality effects that impacted both judicial and extra-judicial proceeds. Servicers struggle to contact borrowers and reach agreements with them during Italy’s nationwide summer vacation period when business activity significantly reduces. Additionally, court activity is limited to the most urgent proceedings only.

Both factors impacted the sector’s performance regardless of servicers’ recovery strategies. All transactions saw lower collections in August 2021 than the six-month pre-Covid average. In August 2020, collections on just two transactions were slightly above the preCovid average but even then, the overall month-on-month decline was 59%. The monthon-month drop in August 2019 was 60%. This report shows the performance of the Italian NPL securitisations rated by Scope on a deal-by-deal basis based on monthly servicing reports available to August 2021.

As reported by Financial Times the Italian government is attempting to push back pressing deadlines over its sale of Monte dei Paschi di Siena as negotiations with would-be acquirer UniCredit hit a major stumbling block. The Italian Treasury, which bailed out MPS in 2017, is required to sell off its stake in the world’s oldest bank by December 31 under conditions set by the European Commission.

According the newspaper:

negotiators for the Treasury and UniCredit are “significantly apart” over how much capital the government would be required to inject into MPS, according to people involved in the talks

The impasse has led the Italian government to make inquiries to the EU over whether its deadline to sell the stake in MPS could be pushed back into next year. While finding a single buyer for the 64 per cent stake would prove tricky should the UniCredit deal collapse, Treasury officials are confident they can recapitalise the business and reduce the MPS holding over time in smaller sales. The ministry of finance is also considering extending another deadline that runs out on December 31 over the treatment of deferred tax assets in takeovers. This benefit was introduced to make the MPS takeover more palatable to buyers.

DoValue, ha annunciato che, attraverso la sua controllata doValue Greece, ha stipulato un nuovo mandato di servicing in relazione a un’importante cartolarizzazione (Progetto Frontier) di crediti deteriorati nel paese effettuata da National Bank of Greece (Nbg). Il mandato aumenterà le masse in gestione di doValue in Grecia di circa 6 miliardi di euro (passando da 26 miliardi di euro al 30 giugno 2021, a 32 miliardi), rafforzando la leadership della società nel paese. Leggi l’articolo.

The European Banking Authority (EBA) published its Risk Dashboard for the second quarter (Q2) of 2021. The data indicate that banks are benefitting from the economic recovery with RoE remaining broadly similar to the previous quarter. Capital ratios remained stable and there was a further decline in NPL ratios. Operational risks remain elevated mainly due to cyber and ICT related risks.

The aggregate NPL ratio continued to decline, reaching 2.3% at end Q2. Due to the uneven impact of the pandemic on corporates, sector level data confirms increasing divergence of asset quality. For accommodation and food services, the NPL ratio rose further from 9% to 9.6% quarter on quarter (QoQ) and for arts, entertainment and recreation from 7.9% to 8.2%. Forborne loans increased further and were up by 3.7% in Q2. The forbearance ratio rose accordingly by 10 bps to 2.1% in Q2. The stage 2 ratio declined from 9.0% to 8.8% QoQ.

Asset quality of exposures under moratoria and PGS deteriorated further. Whereas loans under existing EBA eligible moratoria declined by EUR 80bn in Q2 to EUR 123.4bn, PGS loans remained roughly stable at around EUR 377bn. The NPL ratio increased from 3.9% to 4.5% for loans under current moratoria, from 4.5% to 4.7% for loans under expired ones and from 1.4% to 2.0% for PGS loans. In Q2 2021, the share of stage 2 loans increased by 1p.p. to 28.2% for loans currently under moratoria, while it reached 24.4% (up from 23.6% in the previous quarter) for loans with expired moratoria. For PGS exposures it increased from 13.6% to 18.5%.

DoValue, ha annunciato che, attraverso la sua controllata doValue Greece, ha stipulato un nuovo mandato di servicing in relazione a un’importante cartolarizzazione (Progetto Frontier) di crediti deteriorati nel paese effettuata da National Bank of Greece (Nbg). Il mandato aumenterà le masse in gestione di doValue in Grecia di circa 6 miliardi di euro (passando da 26 miliardi di euro al 30 giugno 2021, a 32 miliardi), rafforzando la leadership della società nel paese. Leggi l’articolo.