Non-performing loan levels continue to remain manageable for European banks, helped by portfolio sales and continuing government support measures. However, economic and geopolitical uncertainties are overshadowing the outlook for asset quality.

The EY NPE tracker is a quarterly publication that aims to monitor key developments in European credit and NPE markets. It draws on data from European regulators and supervisors, quantitative data from other credible sources, and EY teams’ engagement with a wide range of clients.

Key market trends at this sensitive moment are:

Europe’s Stage 2 classified loans are continuing to grow, indicating potential future NPL volumes.

Based on the latest market communications, European banks’ asset quality sentiment is slowly declining and continued pressure in future quarters is likely.

Government support and moratoriums continue to delay NPE creation across European banks, but are expected to mostly end in FY22.

Looking ahead, it is likely to see NPE volumes increase as market effects of geopolitical events are felt, especially in energy and consumer sectors of the economy. Banks’ ability to identify these macro trends and respond accordingly remains critical.

Data on international financial reporting standards (IFRS) loan categories shows that European banks’ ratio of Stage 2 loans (those performing but with increased risk) amount to €1,939b, growing from 9.1% in 1Q22 to 9.5% in 2Q22. This marks a reversal of the decreasing trend seen throughout 2021, following the peak of 9.1% reached in 4Q20. The key European markets driving the quarter-on-quarter (QoQ) increase in Stage 2 provisioning ratios are Germany (+1.5%), France (+1.0%), Italy (+0.5%) and Cyprus (+0.1%). Conversely, Portugal (-0.8%), Ireland (-0.7%), Netherlands (-0.6%), Poland (-0.5%), Greece (-0.5%) and Spain (-0.5%) saw a decrease in Stage 2 classified loans.

Based on the data collected, it appears that French, German and Dutch banks have the greatest short-term expectation of increasing NPLs. The Spanish and British banks that predicted higher NPL inflows in the previous quarter now expect a stable outlook, after cautiously increasing provisions in 1Q22. According to the credit conditions survey conducted by the Bank of England during 3Q22, British lenders saw the net percentage balance for changes in default rates on secured household lending increase slightly in Q3. This is expected to increase in Q4 for secured, unsecured and corporate lending to businesses of all sizes. Similarly, the Bank of Spain warned in early April of an increase in delinquencies due to the deteriorating macroeconomic conditions. Subsequently, NPL ratios have led to the tightening of credit terms on newly underwritten loans.

As detailed in the previous EY reports, the COVID-19 pandemic prompted most European countries to create some form of loan moratorium or public guarantee scheme to support businesses. A number of these government schemes had been extended into 1H22. Therefore, some of the impact caused by the pandemic is likely to emerge during the course of the current year.

Evidence of the unwinding of government support comes from loans outstanding with expired moratoriums, which stand at €615.9b as of 2Q22, 3.0% of the total loan volume. Of these loans, 6.2% are non-performing, indicating strong exit performance after the moratoriums.

Across Europe, the total stock of NPLs in 2Q22 was €371.1b. This represents a 3.5% decrease QoQ and a 16.1% YoY fall. France remains the largest contributor to the region’s NPLs (€109.7b), followed by Spain (€78.9b) and Italy (€51.8b). Collectively, these markets account for 65% of Europe’s NPL stock by value.

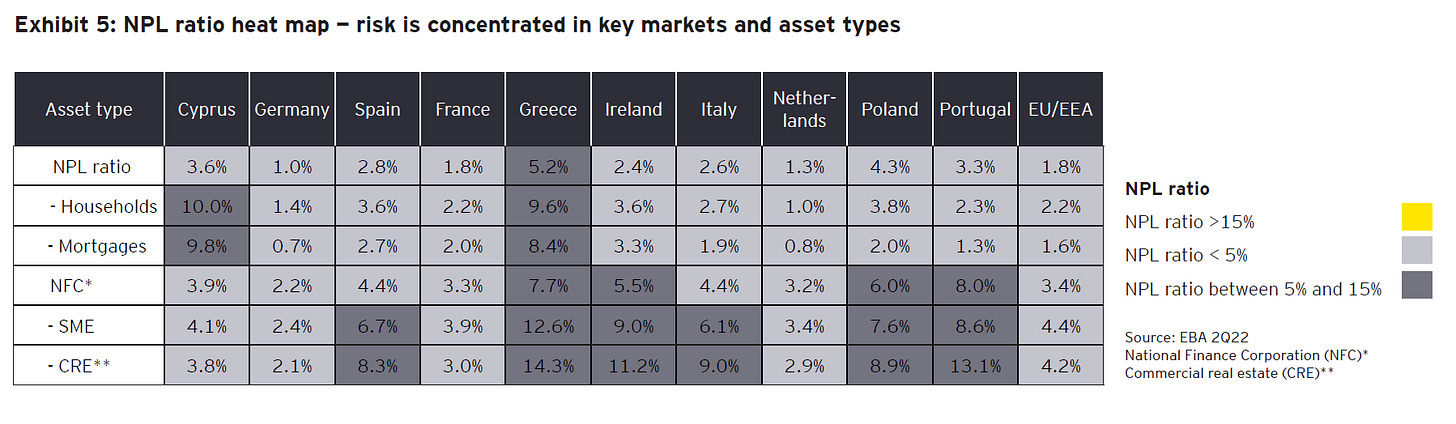

The European NPL ratio was 1.8% in 2Q22, a 0.1% decrease from 1Q22. Noteworthy countries’ NPL ratios include Greece (5.2%), Poland (4.3%), Cyprus (3.6%) and Portugal (3.3%). It should be noted though that the NPL ratio decreased across all the major European nations covered in this report.

Link to the report

https://www.ey.com/en_gl/financial-services-technical-resources/non-performing-exposure-tracker-q4-2021

Check my personal blog mostly in Italian

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics