The European Banking Authority (EBA) has released its Q1 2024 quarterly Risk Dashboard (RDB), providing aggregated data for major EU/EEA institutions along with the Risk Assessment Questionnaire (RAQ), a bi-annual survey of banks' future expectations

EU banks are experiencing improved profitability and stronger capital positions due to wide interest margins. However, credit risks are emerging, with an increase in non-performing loans (NPLs) observed in the first quarter. Most banks anticipate further deterioration in asset quality for commercial real estate (CRE), small and medium-sized enterprises (SMEs), and consumer credit over the next 6-12 months.

These banks maintained strong profitability in Q1 2024, with a return on equity (RoE) of 10.6%, slightly higher than the previous year. Net interest margins increased to 1.69%. However, with monetary easing and rate cuts expected, banks foresee a negative impact on their interest income and overall profitability.

The Common Equity Tier 1 (CET1) ratio of EU/EEA banks remained stable at 15.9%, slightly up from Q1 2023. Despite rising capital requirements, strong organic capital growth sustained this ratio. The Net Stable Funding Ratio (NSFR) increased marginally to 127.2%, while the Liquidity Coverage Ratio (LCR) dropped from 168.3% to 161.4%, returning to Q3 2023 levels. This change was due to a decrease in cash components and an increase in central government debt.

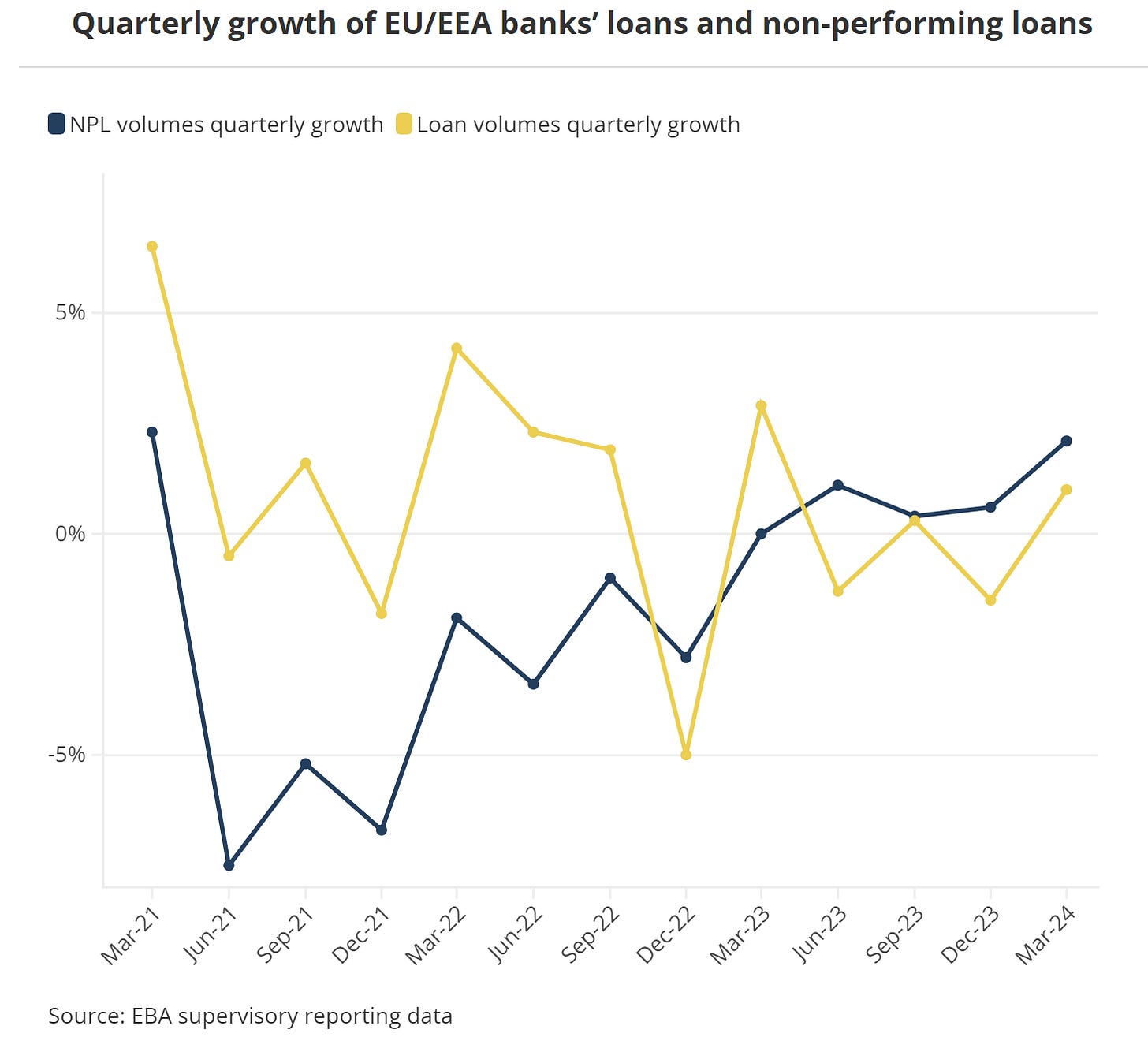

EU banks reduced their loans to households and non-financial counterparties by 0.2% quarter-on-quarter, mainly driven by declines in SME loans (-0.8%) and mortgages (-0.3%). However, consumer credit and commercial real estate loans grew. Many banks plan to expand their loan exposure across various segments, excluding commercial real estate.

Non-performing loans (NPLs) increased by 2% quarter-on-quarter, reaching a ratio of 1.86%, with the most significant rise in the SME segment. The cost of risk for EU/EEA banks also increased, reaching levels not seen since the pandemic in 2020. Although the allocation for stage 2 loans slightly declined to 9.4%, it remained near its peak from Q4 2023.

Operational risks have become more significant, with fraud emerging as the third most relevant driver. Cyber risks and data security remain the top operational risks, with an increase in both the frequency and sophistication of cyber-attacks.

The potential introduction of central bank digital currencies (CBDCs) raises concerns among banks regarding higher operational expenses, funding costs, and declining fee income. Banks are more worried about the indirect effects from non-bank financial institutions, which could impact the banking sector.

Entering Italian NPE Market is a newsletter and a Linkedin Group focused on News, Updates and Insights on Italian Banks, Ditressed Credit Market, Fintech and Real Estate.

Relevant Links:

https://www.eba.europa.eu/publications-and-media/press-releases/profitability-eu-banks-remains-resilient-although-sector-confronted-materialising-credit-risks

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics