DBRS Structured Finance Review

Securitisations have shifted from a niche product to a pan-European solution to support the divestment of NPLs

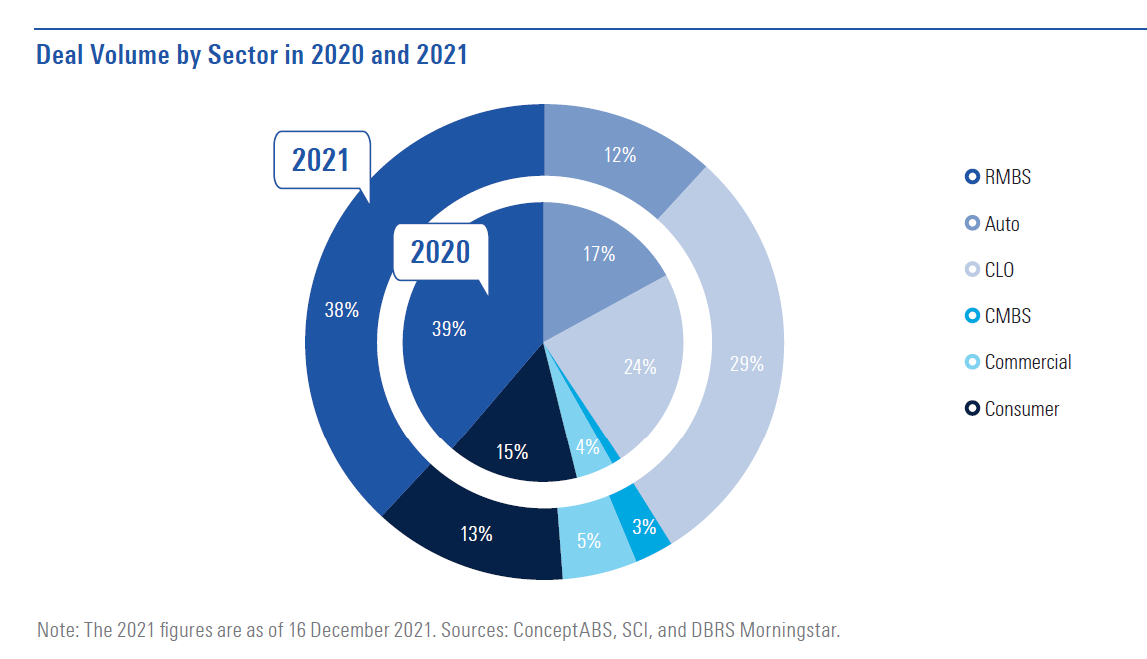

As the world attempts to recover from what all hope to be the worst of the Coronavirus Disease (COVID-19) pandemic, European structured finance has adapted to the new normal with resilience. After the severe hit to the European economies during the 2020 lockdowns, the magnitude of the impact that the measures intended to shield markets from the worst of the pandemic’s effects—which left a question mark hanging over many transactions in 2020—came into clearer focus in 2021.

European NPL securitisations have shifted from a niche product to a pan-European solution to support the divestment of NPLs from banks and to offer investors access to the NPL market in bond format, with securitisation becoming a key tool in ensuring that nonperforming exposures (NPEs) place less of a burden on bank balance sheets. The Italian Garanzia Cartolarizzazione Sofferenze (GACS) and, more recently, the Greek Hercules Asset Protection Scheme (HAPS) have given Italian and Greek banks, respectively, leeway to securitise exposures and move them off their balance sheets.

Italian NPL issuance had been declining since 2014, but once again comprised the bulk of publicly rated transactions in 2021. Nevertheless, the majority of NPL securitisation transactions in 2021 were private, with the year also continuing the emergence of Greek NPL securitisations in this space following their breakthrough in 2019 and 2020. A large portion of the Greek transactions are of considerable scale and have made a substantial contribution to this year’s securitised gross book value (GBV), but are not included in our issuance numbers above. Spanish and Portuguese NPL transactions also made a comeback to the DBRS Morningstar-rated universe this year, with the issuance of Retiro Mortgage Securities DAC (GBV of EUR 678 million in Spanish loans originated by multiple originators) and Scalabis STC S.A, respectively.

a partnership tra Luigi Luzzatti S.C.p.A. (“Luzzatti”) e il Gruppo Prelios (“Prelios”) ha chiuso il 2021 con la nascita e i primi investimenti del Fondo di investimento alternativo di tipo chiuso riservato denominato Eleuteria dedicato a crediti deteriorati classificati tra le Unlikely to Pay.

La Luigi Luzzatti S.C.p.A., è una società partecipata da 19 banche popolari in gran parte appartenenti alle less significant institutions (LSI), è stata costituita con l’obiettivo di sviluppare attività e servizi in alcuni ambiti strategici, di business e di supporto operativo di comune interesse per le Banche Azioniste.

Il Fondo Eleuteria, istituito e gestito da Prelios SGR, ha la finalità di investire – direttamente o attraverso le notes emesse da SPV dedicate – in crediti UTP vantati verso aziende appartenenti prevalentemente al segmento PMI/Corporate, promuovendo strategie di recupero del credito orientate a riportare in bonis le imprese attraverso una gestione proattiva delle posizioni orientata alla ristrutturazione aziendale.