DBRS Morningstar has published a commentary analysing moratoria usage in the European banking sector. The analysis is based on data reported at end-June 2021 by a sample of 35 banks in Europe, including banks headquartered in France, Germany, Italy, the Netherlands, Spain, Sweden, Portugal, Finland, Ireland, and the United Kingdom (UK).

Total loans with moratoria granted (including both outstanding and expired) have remained at similar levels to a year ago as of end-H1 2021 based on DBRS Morningstar's sample of European banks. On the other hand, State Guaranteed Loans granted by European banks have shown significant growth since end-H1 2020.

The impact of payment holidays on the 272 Structured Finance transactions rated by DBRS Morningstar 272 DBRS Morningstar rated transactions across 8 jurisdictions. Italy, UK and Portugal have been the jurisdictions with the higher number of reported payment moratoriums in their portfolios.

Secondo indiscrezioni diffuse dal Sole24Ore entro la fine del corrente anno dovrebbero venire perfezionate sei cartolarizzazioni di crediti in sofferenza (Npl) per un importo totale di circa 10 miliardi di euro. Le operazioni più rilevanti per importo sarebbero:

Intesa Sanpaolo per un controalore compreso tra 2,5 e 3 miliardi

Unicredit per un importo tra 1,5 e 2 miliardi

Credit Agricole Italia per un improto di circa 2,5 miliardi

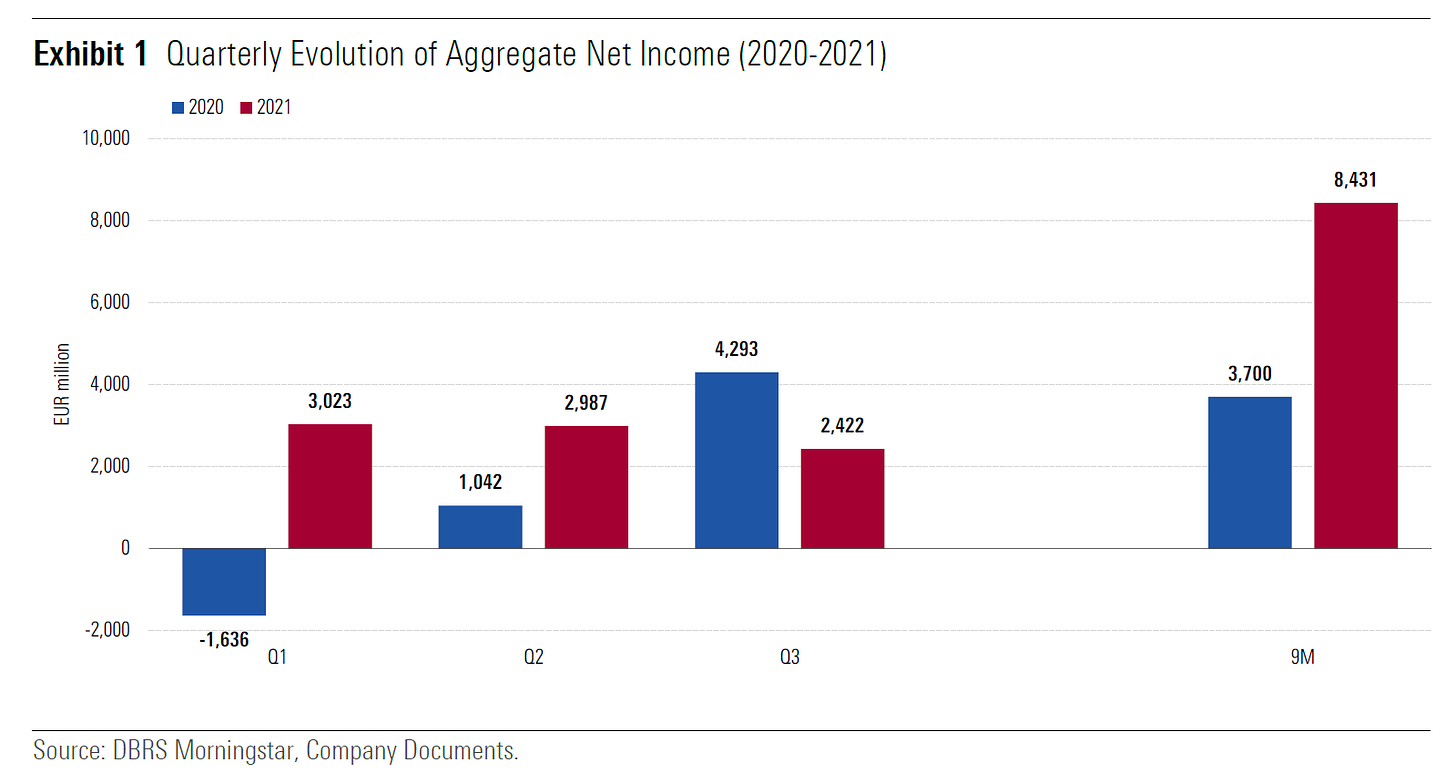

Italian Banks: Improved Operating Environment and Better Asset Quality Dynamics Underpinned 9M 2021 Results

Italian banks reported an aggregate net profit of around EUR 2.4 billion in Q3 2021, down 44% year-on-year (YoY), but up 135% YoY when excluding a sizeable positive non-recurring impact attributable to the acquisition of UBI Banca by Intesa Sanpaolo in Q3 2020. For 9M 2021, the aggregate net profit was around EUR 8.4 billion, up from EUR 3.7 billion in 9M 2020.

In Q3, revenue generation was supported by the improved operating environment compared to the same period last year, which led to a significant rebound in net fees. Whilst net interest income (NII) remained pressured in Q3 YoY, we note that it increased for the second consecutive quarter.

In our view, a potential hike in interest rates to counteract the higher inflation arising from the pandemic could be positive for banks with higher reliance on NII, if the impact from higher rates on the demand for new credit were manageable.

Loan loss provisions continued to normalise, supported by a higher than previously envisaged improvement in the macro environment, better asset quality dynamics and contained loan quality deterioration from the expired moratoria.

Il 28 Ottobre 2021, ha debuttato ufficialmente CreditChange, l’innovativa Piattaforma digitale dedicata al trading dei Crediti Distressed, in partnership con l’Osservatorio NPE Market di Credit Village, si rivolge alla principale community italiana del Credit Management.

Nato dall’esperienza pluridecennale di un team di Senior Credit Manager, rappresenta un luogo ideale dove far incontrare domanda e offerta, sia per il mercato primario che secondario, che permetterà agli operatori di confrontarsi in un contesto ampio e professionale, la mission è di offrire alle imprese il miglior servizio di pubblicazione e ricerca delle opportunità presenti sul mercato, favorendone le transazioni sia per i Seller che per i Buyer.