DBRS on Italian Banks

Higher Interest Rates Underpin Results - Asset Quality not yet deteriorated

DBRS Released a commentary that analyses the Q3 2022 results for the five major Italian banks: Intesa Sanpaolo, UniCredit, Banco BPM, BPER, and Banca MPS. The report points out how higher interest rates positively contributed to 9M 2022 Results while Asset Quality does not show signs of deterioriation.

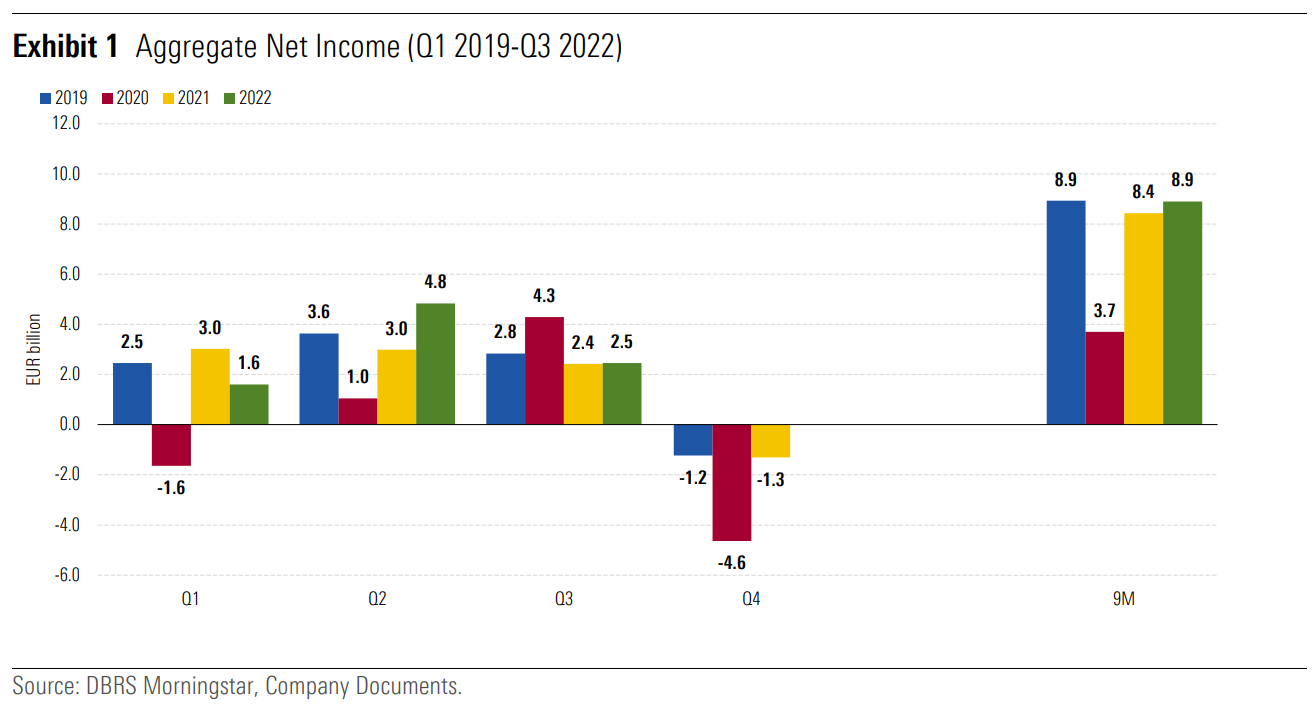

Large Italian banks reported an aggregate net profit of EUR 2.5 billion in Q3 2022 (Exhibit 1), up 2% compared to Q3 2021, and up 16% on an underlying basis when excluding the impact from Russia/Ukraine, the badwill from the acquisition of Banca Carige by BPER, and restructuring costs net of a positive tax impact at Banca MPS. Aggregate net profit was up 5.5% Year-on-Year (YoY) in 9M 2022, or up 14% excluding these one-off items. 9M 2022 results benefited from higher revenues, lower operating expenses, and lower underlying credit costs.

Revenues for the nine months were supported by higher net interest income (NII) due to higher interest rates and higher volumes. The full benefit from higher interest rates has not fully accrued yet, however the contribution to NII from TLTRO will decline going forward after the ECB's recent decision to change the conditions associated with it as part of its tightening in the monetary policy to counteract high inflation. Also, the incremental benefit from any additional hike in interest rates will progressively decrease as part of the upside would be absorbed by increasing funding costs.

Loan Loss Provisions (LLPs) were up YoY in 9M 2022, however they were down when excluding Russia and Ukraine, reflecting banks' improved risk profiles. The average annualised cost of risk in 9M 2022 remained below the level experienced in the 2019-2021 period. The cost of risk might start to incorporate the need for higher provisions in the coming quarters due to high inflation, slower economic growth and higher interest rates. Nevertheless, in our view, despite the considerable degree of uncertainty, it should remain below the average level experienced in recent years considering banks' stronger risk profiles. Q3 2022 did not provide any indication of a deterioration in asset quality yet, while de-risking of direct exposures to Russia and Ukraine continued.

New Non-Performing Exposure (NPE) formation remained under control in 9M 2022 with an average default rate on total customer loans below 1%, despite the expiry of support measures granted during the COVID-19 global pandemic. We note that the European Commission (EC) recently approved Italy's plan to transfer certain State-guaranteed loans from banks to the State-owned bad loan manager AMCO. Our understanding is that the proportion of loans under the scheme should be limited at the initial stage compared to the total State-backed loans granted during the pandemic, however banks could get some relief given that such loans are now more vulnerable in an economic environment with higher energy bills, higher interest rates and weaker economic activity.

Italian banks' asset quality metrics remained flat in Q3 2022, with the average gross and net NPE ratios at 3.8% and 1.9% respectively as of end-September 2022 (Exhibit 7). However, the de-risking achieved in recent years has been significant, implying a cumulated reduction in the aggregate stock of gross NPEs of 55% since end-2019. The average total NPE coverage remained adequate at around 51% as of end-September 2022. Our view is that de-risking should continue going forward although at a slower pace considering the significant progress achieved so far. This will contribute to absorbing part of the new NPE inflows which we expect to materialise in the coming quarters due to a deterioration in the operating environment. Also, we expect some measures approved by Italy's recently established government to partly alleviate the pressure on households and enterprises.

Since Russia's invasion of Ukraine, Italian banks have reduced their direct exposures to these countries. The exposures are concentrated in large, diversified and well capitalised banks (Intesa Sanpaolo and UniCredit), and most of the exposures remain performing, but with a prudential reclassification to Stage 2 (exposures whose credit risk has increased since origination). In our view, the banks should be able to absorb a negative impact from these exposures in an extreme loss scenario, considering the reduced exposure and their adequate capitalisation.

Check my personal blog mostly in Italian

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics

Link to the report

https://www.dbrsmorningstar.com/research/405298