DBRS on Italian Banks

Good Results in H122 Despite Significant Provisions For Russia and Ukraine

DBRS released a commentary on Q2 2022 results for the five major Italian banks: Intesa Sanpaolo, UniCredit, Banco BPM, BPER, and Banca MPS.

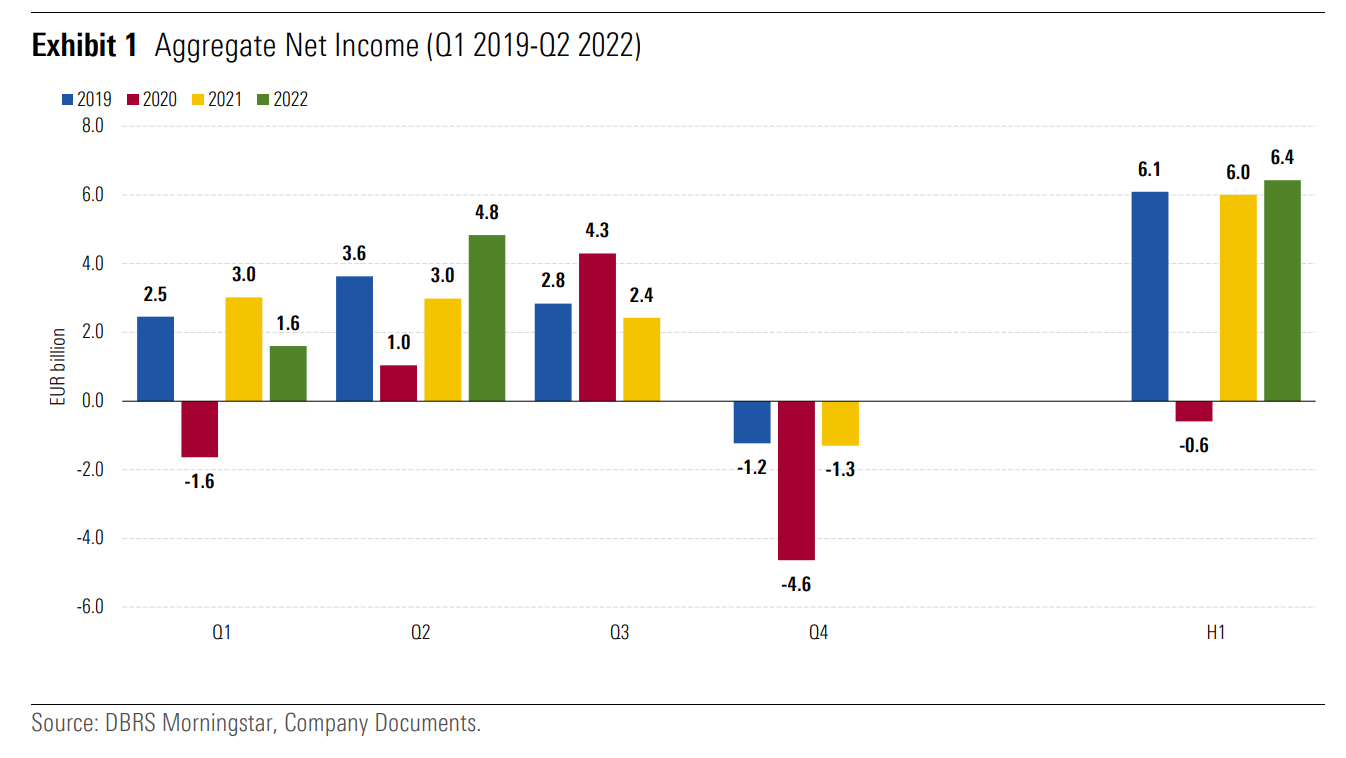

Large Italian banks (Intesa Sanpaolo, UniCredit, Banco BPM, BPER, and Banca MPS) reported an aggregate net profit of EUR 4.8 billion in Q2 2022 (Exhibit 1), up 62% compared to Q2 2021, or up 20% excluding both the impact from Russia and Ukraine and the badwill arising from the acquisition of Banca Carige by BPER. For the half-year 2022, aggregate net profit was up 7% Year-on-Year (YoY), or up 13% excluding Russia-Ukraine and the badwill. The performance in H1 2022 was driven by higher revenues, lower operating expenses, and reduced credit costs on an underlying basis.

Revenues for the half-year benefited from growth in core revenues and also trading operations, supported by higher business flows fuelled by a recovery in the Italian economy from the pandemic, coupled with higher interest rates. Italian banks' sensitivity to the further rate hikes expected in the coming months is significant, as liabilities tend to reprice more slowly than assets, and more significantly after rates reach certain thresholds.

Loan Loss Provisions (LLPs) were up YoY in H1 2022, however they were down markedly when excluding Russia and Ukraine, reflecting banks' overall improved risk profiles. The average annualised cost of risk in H1 2022 remained below the level experienced in 2019-2021 period.

DBRS sees Italian banks as better positioned to withstand a potential deterioration in credit quality and subsequent need for higher provisions due to headwinds from inflation, considering their strengthened risk profiles, leaner cost structures, availability of overlay provisions due to COVID-19, and the revenue upside from higher rates. De-risking continued in Q2 2022, including exposures to Russia and Ukraine. The room to carry out further de-risking of these exposures could be more limited considering the reduced number of players able to buy these assets due to the sanctions.

Italian banks managed to maintain adequate capital buffers in the current challenging operating environment, driven by good organic capital generation and sizeable de-risking. Also, banks were able to absorb the negative impact on their capitalisation from the widening in the Italian sovereign spread connected with heightened volatility from Russia's invasion of Ukraine, and exacerbated by the recent political crisis in the country which has resulted in snap elections in September.

Reference:

https://www.dbrsmorningstar.com/research/401168