DBRS released a commentary on NPL securitizations in Europe. The report pointed out that the new issuance slowdown in nonperforming loans that began in 2022 is likely to reverse during the course of 2023, with the public issuance volume broadly in line with the volumes of 2020/2021, as central banks’ interest rate policies become more stable and the government asset protection programmes are renewed.

Expectations for 2023 issuance remain dominated by the performance of peripheral economies and, in particular, Southern European jurisdictions; however, considering the systemic scale of the problem at the European level, it is possible that we will see rated transactions in new jurisdictions and, considering the limited cost for governments as compared with other solutions, the introduction of schemes similar to Italy’s Garanzia Cartolarizzazione Sofferenze (GACS) scheme (which expired in June 2022) and Greece’s Hellenic Asset Protection Scheme (HAPS) (which expired in October 2022) in other jurisdictions might be possible.

From the second half of 2022, uniformly across Europe, increased borrowing costs, high inflation, and elevated energy bills are contributing to slowing economic growth and putting an additional burden on households and corporates. Rising interest rates exert downward pressure on real estate values. On the positive side, unemployment rates have continued to be low since the pandemic highs and household savings have increased during the pandemic. Banks are well capitalised and further de-risked in the past couple of years, reducing the risk of a funding squeeze. Next Generation EU (NGEU) funds anticipated in Italy, Spain, and Cyprus should positively affect the respective macroeconomic performance. Court closures and the subsequent bottlenecks at courts are clearing (with the exception of Spain).

For the early Italian GACS transactions most affected by the timing delays, the increasing GACS fees over time are likely to make the effect of delays in recoveries more pronounced, which could result in further rating migration in 2023. In 2022, DBRS Morningstar upgraded its ratings on the senior notes in two Irish transactions to the AA category after significant deleveraging resulting from sizeable portfolio sales. In the current climate, the positive trend of reperforming loan sales of previous years may be difficult to maintain.

Italian NPL Credit Outlook: Negative

Worldwide increasing energy prices, high inflation, and interest rates are also affecting the Italian economy. DBRS Morningstar expects the rising interest rates to put pressure on the real estate prices (and the secured recoveries from NPL securitisations).

On the other hand, as a result of the European Commission’s continued focus on the reduction of nonperforming loans during the pandemic, Italian banks have stronger risk and capitalisation profiles compared to the past. Household savings and corporate deposits have also risen, creating some resilience against the headwinds that lie ahead. Unemployment is lower than at the start of the pandemic (Q3 2022: 7.9%; Q2 2020: 9.6%, Eurostat), while GDP growth expectation is positive for 2022 at 3.7% and negative for 2023 at -0.1%, according to DBRS Morningstar’s recently published Baseline Macroeconomic Scenarios. The new government signals policy continuity and a commitment to the National Recovery and Resilience Plan (NRRP).

Court closures and the subsequent bottlenecks at courts, which led to recovery delays for NPL securitisations and to servicers switching away from judicial recovery strategies towards more amicable strategies such as debt-for-asset swap or debt purchase options, are clearing. In the servicer reports, DBRS Morningstar observes that the comparative decline in percentage of judicial recoveries in periodic collections is reversing. This should positively affect future updated business plans for DBRS Morningstar-rated transactions.

Transactions issued prior to the pandemic did not anticipate the timing delays and strategy changes caused by court closures during the pandemic in their business plans. Consequently, varying corrections were made in updated business plans of these transactions during the course of the pandemic. This also led to lower-than-anticipated collections for these transactions during this time, both in terms of amount and timing of collections. NPL securitisations issued during and after the pandemic had built the effects of the pandemic into their business plans and therefore display stronger performance compared with expectations.

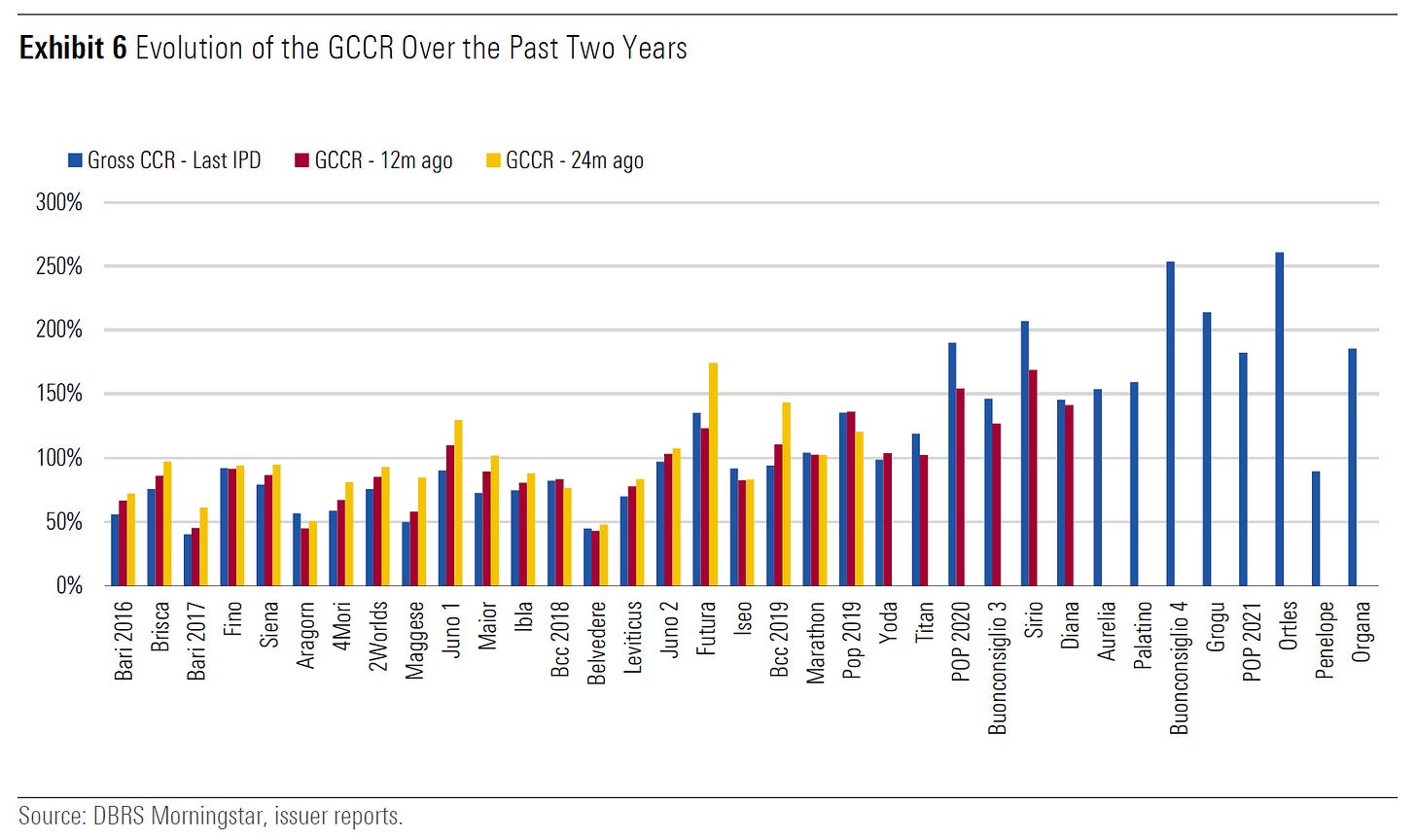

On the positive side, we observe a slowdown in the securitisation performance deterioration in 2022. Exhibit 6 above shows a consistent reduction in performance during the first year of the pandemic (gross cumulative collection ratio (GCCR) 24 months ago vs. GCCR 12 months ago) whereas the more recent performance (Gross CCR – Last IPD vs. GCCR 12 months ago) is more mixed. There is a slowdown in the gross cumulative collection ratio deterioration and we can even see improvement in the performance of some of the Italian transactions.

However, for the early GACS transactions most affected by the timing delays, the increasing GACS fees over time are likely to make the effect of delays in recoveries more pronounced, which could result in further rating migration.The Italian asset protection programme, GACS, which started in 2016 and was amended during its renewal in 2019, expired on 14 June 2022. The consensus of market participants is that there will be a renewal, albeit with some structural changes. There is no official announcement as of the date of this report.

GACS played a significant role in de-risking the Italian banks. However, unlike Greece’s HAPS, it only covered denounced loans and did not address the unlikely-to-pay (UTP) loans. The large stock of Italian UTPs still need to be worked out and securitisations outside of GACS could be a solution for these portfolios in 2023.

The NPL ratio for banks followed by EBA at the end of Q2 2022 stood at 2.6% while, on the Italian Central Bank website, this ratio stands at 3.5% for all Italian banks – suggesting higher NPL ratios for smaller banks. Despite data collection challenges involved with these types of transactions, 2023 could potentially bring more pooled transactions for smaller banks.

This newsletter is free please consider supporting it with a small donation

Check my personal blog mostly in Italian

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics

Link to the Report

https://www.dbrsmorningstar.com/research/408187/european-npls-2023-credit-outlook