Countdown to the 17th edition of Credit Village Day, one of the most important events in the credit management industry, which will take place on 21 November in Milan with a completely revamped format under the banner of sustainability and HI-TECH and in the spectacular new location of Gadames 57.

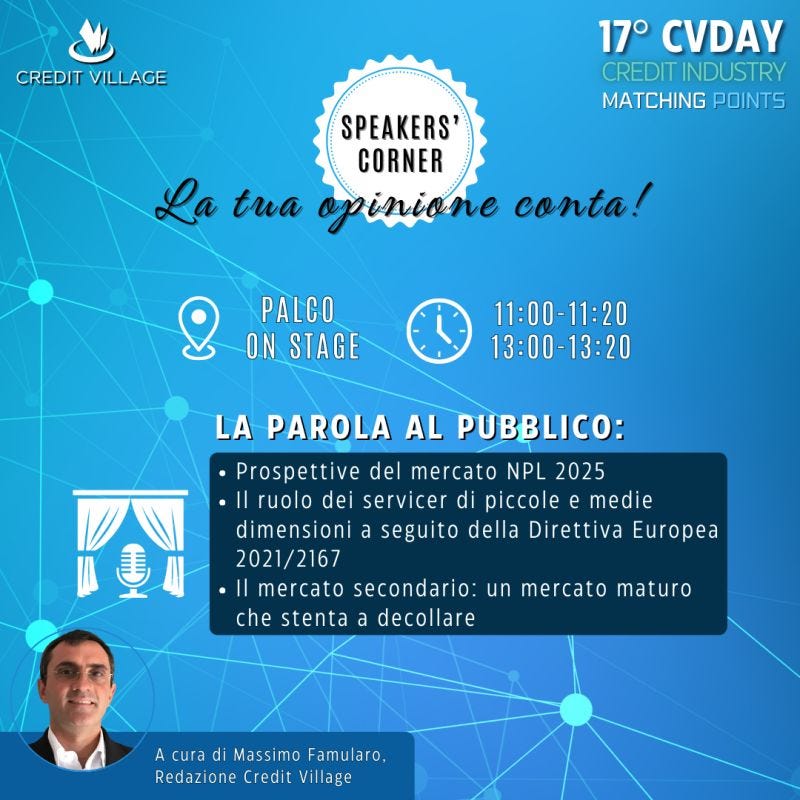

The real protagonist of this edition will be the audience in the hall who, thanks to the Credit Village Speaker's Corner, one of the great novelties of this year's edition, will have the opportunity to actively participate in the debate on some of the hottest topics of the market, with dedicated moments of interaction that will make the confrontation between the players of the sector a more dynamic and inclusive experience.

In the MAINSTAGE the main market players will discuss some of the most topical issues of strategic interest for the future of the industry: Npe market scenarios and the impact that regulations will have on them, the evolution of traditional de-risking, the opportunities and critical issues arising from the transposition of the EU directive on the management and disposal of impaired loans and the new frontiers of AI in credit management, the growing importance of ESG criteria as a fundamental approach in the valuation of companies in the financial world, social value securitisation, expertise as a strategic driver and much more!

The proceedings will open with an interview with Roberto Sergio, Director of Credit Village's NPE Market Observatory, by Morya Longo, Journalist Il Sole 24 Ore, entitled 'After the storm. Il viaggio del mercato Npe" in which some of the most significant data on the NPE market processed by Credit Village's Observatory will be presented and current scenarios, future prospects and developments in the sector will be discussed.

This will be followed by a market overview by Gabriele Guggiola Partner PwC Italia Financial Services. The first session, entitled 'Evolution of traditional de-risking: new forms of asset class', moderated by Guggiola, will be devoted to the new concept of derisking, extended to all those asset classes on which banks will want to continue to operate without taking full risk, with a view to minimising prospective risks. This will concern different asset classes (High Risk, ESG brown, Real Estate) and will see the bank co-investing and co-managing certain counterparties from an early stage, together with third parties. The new market context, the reduction in Net NPL Ratio values and default rates now drive banks to place greater emphasis on the monitoring phase, including through prospective analytics tools useful for defining strategic derisking actions on the UtP segment and potential Stage 2s.

Speakers of the panel will be: Vanes Bolandrini, CEO Rad Informatica; Diego Bortot, Chief Asset Management, Real Estate & Servicing Zenith Global; Gianluca De Martino, Head of Group Distressed Asset Management UniCredit; Rodolfo Diotallevi, Group Chief Business Development and Innovation Officer Gruppo doValue; Alice Grittini, ISBD Sustainability Manager & Head of ISBD ESG team Intesa Sanpaolo; Nicolò Maria Pannacci, Head of Sales Hoist Italia

The second session, moderated by Gianmaria Galli, Head of Legal & Transaction Management Centotrenta Servicing, will be dedicated to the highly topical issue of social value securitisation. After a market overview by Roberto Anedda, Senior Advisor Nomisma, the following will take the stage for the Round Table entitled "First application experiences of social value securitisation": Francesco Ballarini, ABS Analyst - Portfolio Manager Azimut; Giuseppe Cavallaro, Professor LUISS University and Founder Studio Legale Cavallaro and Studio Legale Associati Legal NPL Company; Alessandro Degli Esposti, CEO Axis; Alessandra Scerra, President Save Your Home; Fabio Stupazzini, Save Your Home Securitisation Manager and Managing Director A&F

The proceedings will continue with an interview with Cinzia Penati, Actionaid Project Manager - NORA Project entitled "The Strength of the Network: BD Business Defence and Sydema in action against gender-based violence". The third session, moderated by journalist Morya Longo, is entitled "The Credit Servicing Directive: opportunities of the reform and new frontiers of AI in credit management" and will be preceded by an interview with Michela De Marchi Vice-President of FENCA and Carlos Ruiz Cabrera, President of ANGECO, who will take stock of the state of the art of the directive's transposition in Europe.

Speakers of the panel will be: Dino Crivellari, Founding Partner of Studio Crivellari & Partners Legal Advisors; Massimo Famularo, NPE Luzzatti SCPA Service Coordinator; Daniele Fiorelli, Managing Partner L&CM Società tra Avvocati; Marcello Grimaldi, President UNIREC;Giuseppe Lucà, Head of Business Development Area Sydema; Emanuele Reale, Advisor to the Board Best SA

Finally, the last session, again moderated by Longo, will be devoted to the topic 'The second market: expertise as a strategic driver'. Panelists will explore the main factors that are hindering the development of a market that, despite its great potential, is struggling to take off. A significant contribution to the discussion will be provided by rating agencies, which will offer independent and authoritative analysis on the market, providing fundamental insights to understand and assess current and future dynamics. Special emphasis will also be placed on the importance of digital marketplaces, strategic platforms for facilitating meetings between buyers and sellers, also at international level. These tools are destined to become increasingly strategic for optimising sale processes and broadening the base of operators.

The topic will discussed by : Gianluca De Carlo, Managing Director ISCC Fintech; Federica Fabrizi, Head of the Structured Finance Analytics Team and CVB Fitch Ratings;Rossella Ghidoni, Director Structured Finance Scope Group; Luca Grimaldi, CEO Faktorec; Paola Marinacci, CEO BD Business Defence; Marco Pasini, Board Chairman & Founding Partner Creditchange

In addition to the MAIN STAGE stage, this year's edition will host another parallel stage, the ON STAGE (the other real novelty of the 17th CvDay), where two Open Innovation speeches by two of the most avant-garde realities in the sector will be held.

The first, entitled 'Sydema always at its customers' side: the Best project', by Daniela Popoiu, Senior Consultant Sydema and Michal Lesniewski, Managing Director BEST; the second entitled 'Optimising recovery strategies with Artificial Intelligence' by Antonio Russo, Partner and Technical Director Sixtema.

We look forward to an unmissable day of discussion and debate interspersed with numerous moments of sharing and networking that will encourage the exchange of ideas and business opportunities among participants.

Enhancements in Supervision of NPEs

The European Banking Authority (EBA) recently published its 2024 follow-up report on the supervision of non-performing exposure (NPE) management by credit institutions. This report builds upon the 2022 peer review, which assessed the implementation of the EBA Guidelines on managing non-performing and forborne exposures (EBA/GL/2018/06) by competent authorities (CAs) across the EU.

Entering Italian NPE Market is a newsletter and a Linkedin Group focused on News, Updates, and Insights on Italian Banks, Distressed Credit Markets, Fintech, and Real Estate.

Relevant Links:

https://www.creditvillage.news/2024/11/14/tutto-pronto-per-il-cvday-appuntamento-il-21-novembre-a-milano-per-la-nuova-edizione-con-un-format-completamente-rinnovato-che-vedra-come-protagonista-il-pubblico-dellevento/

This newsletter is free please consider supporting it with a small donation

See my full professional profile (available for consulting projects)

My Podcast on Financial News and Education

My new Podcast on Italian Politics